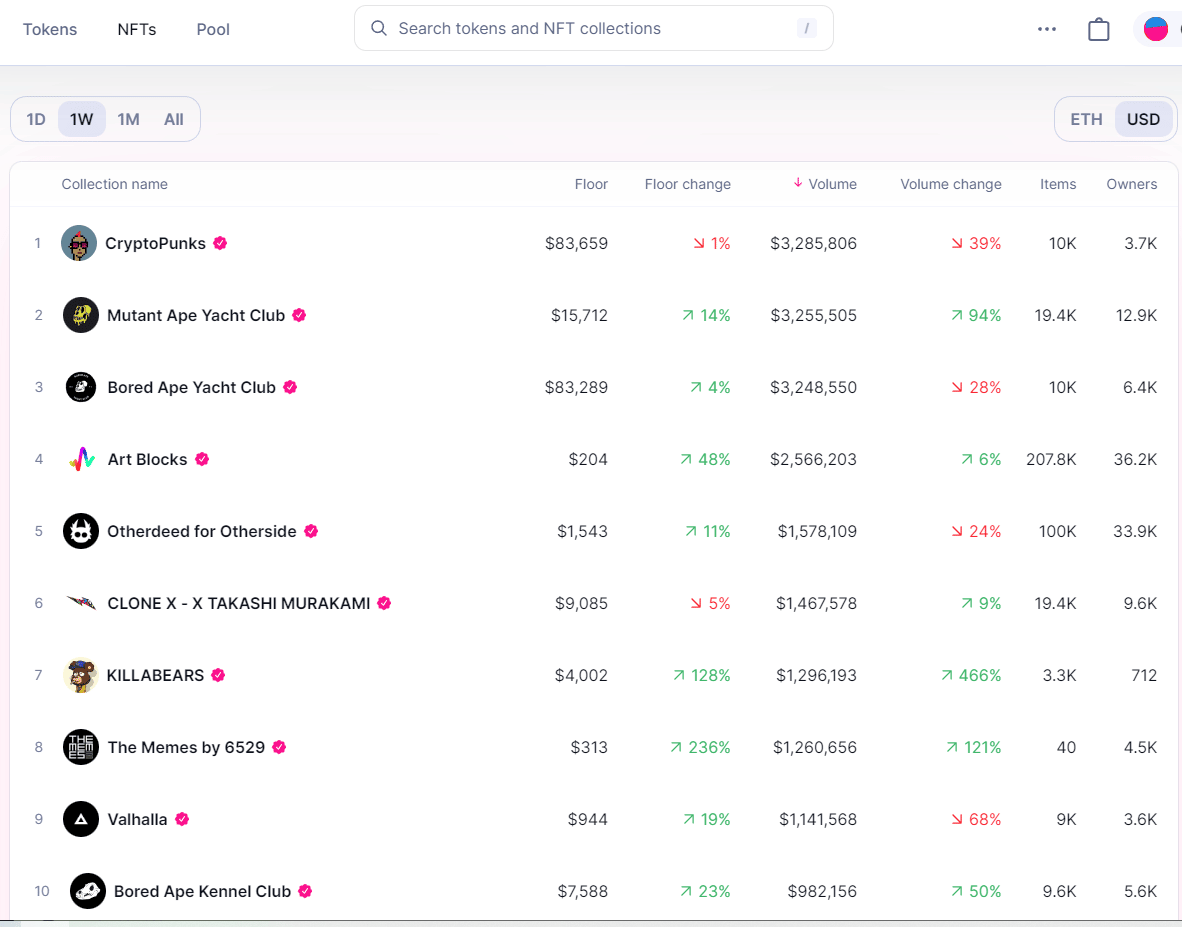

This picture says it all. Note the wall of green:

These rankings are drawn from Uniswap’s new search engine for NFT, called Genie. I’ve been playing with it the last few days.

No, I haven’t figured out to profit from NFTs yet. In the past, I’ve managed to lose money on NFTs, or at the very least, I haven’t sold any at a profit.

But that’s a common occurrence for me with crypto. New sectors pop up, I lose money until I figure it out, and then I don’t lose money.

That doesn’t sound like a sexy winning strategy but I’ve been doing this for more than five years now, so I must be doing something right.

By the way, Genie is free to use.

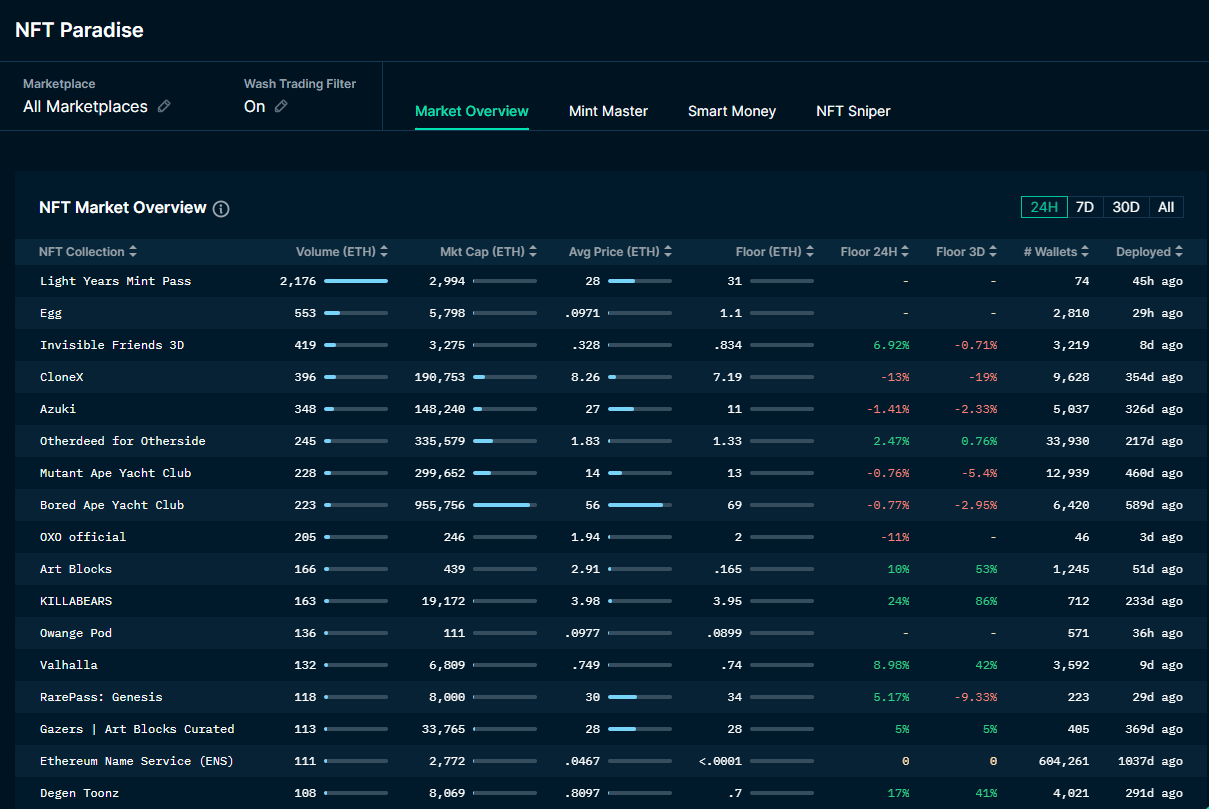

Another analytics tool is Nansen, which is not:

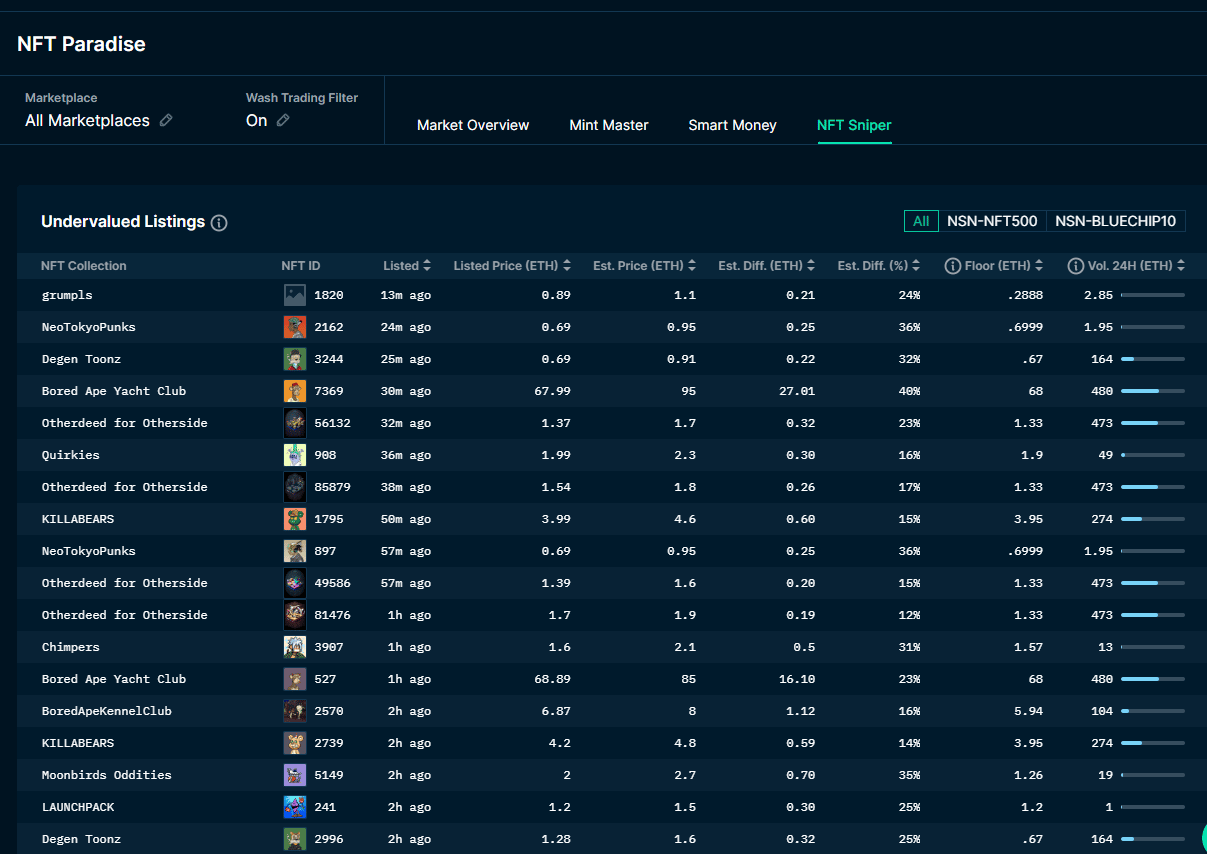

Because you pay for Nansen, it’s got a lot more tools than Genie. Right now I’m looking the NFT Sniper section:

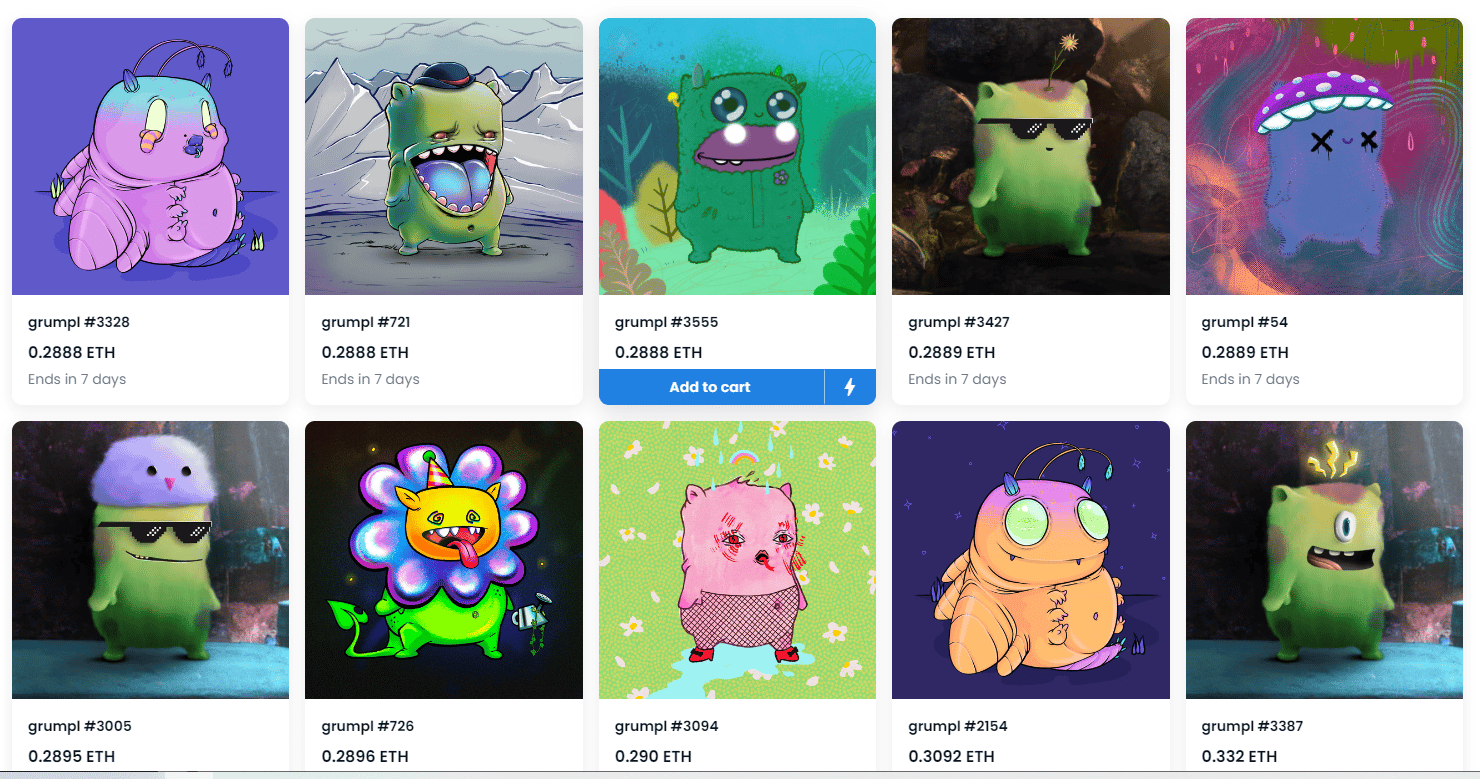

According to Nansen, the grumpls NFT collection is most undervalued:

Now, if you are still with me, I’m sure there is one question you are begging to ask?

Why are we talking about this? What is the value of stupid jpegs tied to a unique address on the blockchain?

I don’t know. But there is a market for NFTs. A huge market. And the market is never wrong. The market is oftentimes irrational, or manic-depressive, but it’s never wrong.

Or as I tell my teenagers, the market is the market and if you don’t understand what I just said, let me repeat myself.

Look at what I wrote two years ago about Uniswap:

” Uniswap is the cryptocurrency darling of the summer of 2020.But it’s also the Playground of the Devil.

To list a token on Uniswap, you need simply need to hire developer who knows how to create one. Right now the cost is about $99, plus a few Ethereum tokens.

Even though these tokens trade like securities, there are no listing requirements for Uniswap. No Securities Exchange Commisions regulations to follow. No regulatory oversight. Nothing.

It’s not the wild west out there. It’s outer space.

There is also no KYC (know-your-customer requirements)..

Therefore, it’s ridiculously easy to manufacture a pump-and-dump scheme on Uniswap and walk out with a lot of (real) cash in your pocket, without a chance of being traced.

That means a lot of people are going to LOSE a lot of money trading on Uniswap, in the long run.

.Obviously 99% of all ERC-20 tokens are crap and will eventually go to zero. In the meantime, most traders are riding the mania train and hoping the greater fool will bail them out.

However, you can’t stop the future, and this is it.

I’ve been a penny stock trader for decades now, and bought my first bitcoin in 2014. Whenever I see a gold rush, my first thought is: Who is selling the picks and shovels?

And the answer is: With Uniswap, the users are providing the picks and shovels.”

I was wrong about Uniswap. People didn’t lose money on the DEX exchanges. They lost money on centralized exchanges, like FTX.

Two years ago, I thought Uniswap was for clowns. The trademark of Uniswap is a unicorn, for heaven’s stake.

Two years later, Uniswap is now valued at $1.6 billion. I do 90% of my trading on Uniswap.

In my career as a crypto trader, I’ve lost track of how many times I’ve thought to myself: That looks really stupid.

But more often than not, that’s where the money is. Like right now, look at the NFT market.

Crypto is dead. Long live crypto.

DJ