I just came back from attending the Annual Planet Microcap Showcase conference that took place in Las Vegas last week.

I have at least four companies on my radar and have written up a preliminary report for my paid subs.

With a little bit more research, I will probably buy at least two of them.

Microcaps are doing great. Nobody is paying attention. Let’s talk about that.

At the conference, there were a lot of lawyers on the floor, along with auditors, transfer agents, and… I hope you get the drift.

I attended a speaking panel where the subject was rules and regulations in the smallcap space and you would think that would be the most boring 45 minutes of your life.

Nope. Lots of horror stories about accounting partners losing their licenses because they didn’t dot an “i” or cross a “t.” Crazy stories about trying to file financials on time and not succeeding.

The regulators, to put it mildly, have really dropped the hammer this year, and not just in crypto.

As a result, lots of companies are even too scared to issue a press release, unless it’s laden with enough legal jargon that the reader falls asleep before noticing that sales at such-and-such a company were up 80% in the first quarter.

This is not bad news, as it leads to splendid buying opportunities. For example last January, bitcoin mining stocks took and then at the beginning of April, Neptune Digital Assets had a nice bump.

But you do need to be patient which I’m not sometimes.

At last year’s Planet Microcap Conference, I bought a gold exploration company called Satori Resources at 15 cents. It’s now trading at 29 cents.

And yup, I sold it at a small loss about six months ago.

Another reason why microcaps are flying under the radar is the lack of financial press.

As far as I know, there was only one person representing a financial newsletter at the show, and that person was me.

I was so popular there, even the lawyers were willing to talk to me.

There have been a variety of factors that have eviscerated the free financial press. Social media, Twitter especially, 2022 being a terrible year for the market, and again, more regulations regarding what can be said about public companies in general.

To have any chance of making a living writing in the financial sector, you need a LOT of eyeballs. And since nobody cares about quality financial analysis, you have to give them the doom and gloom.

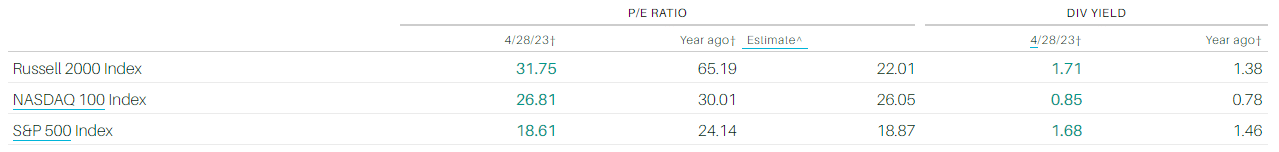

Nobody wants to look at the numbers:

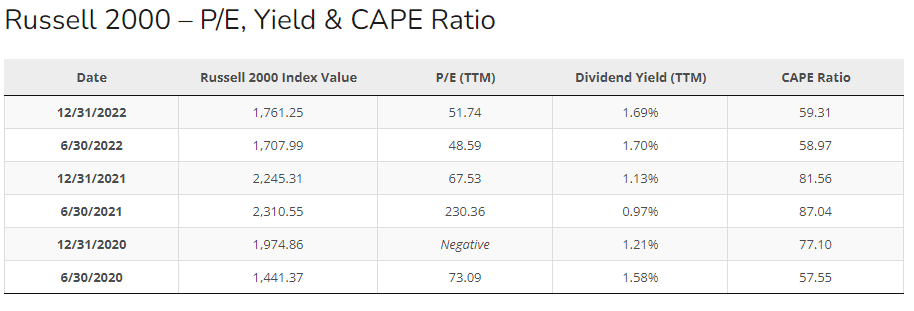

Now if you don’t invest in small-cap stocks, you may think that’s not good. But it is. Look at the price-earning ratio of the Russell 2000 index over the last four years:

https://siblisresearch.com/

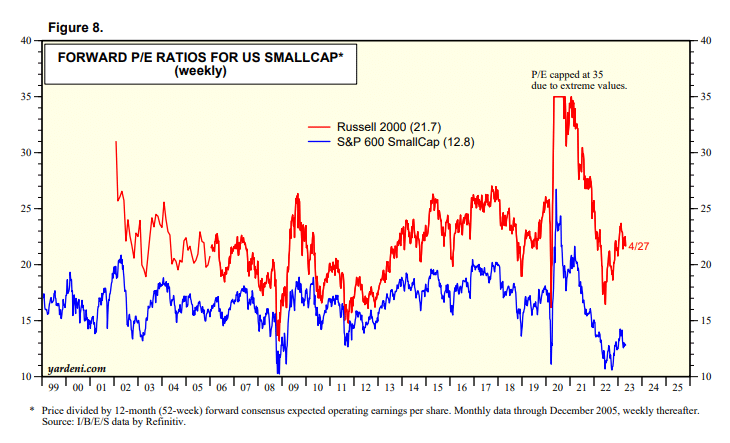

Now let’s go back twenty years. Still looks good. And the S & P 600 Smallcap index looks absolutely fabulous:

But of course, you are thinking to yourself, the current US banking crisis is going to have a huge impact on the market and we are headed to a recession.

That’s what you have been reading. Doom-and-gloom.

But remember, these companies, over the last four years, have survived COVID, followed by the COVID lockdown, followed by inflation, followed by such a dramatic boost in interest rates that US regional banks are failing on an almost weekly basis.

There was no CEO at the conference that I talked to, who is spending ANY time trying to get financing and diluting stock. They were all head-down, running operations, generating cash, and getting leaner and meaner.

This year is a good year to invest in microcaps. If you have the guts and the patience.

DJ