Let’s start with Bitcoin. Year-to-date, it’s up 65%, although flat for the last two months

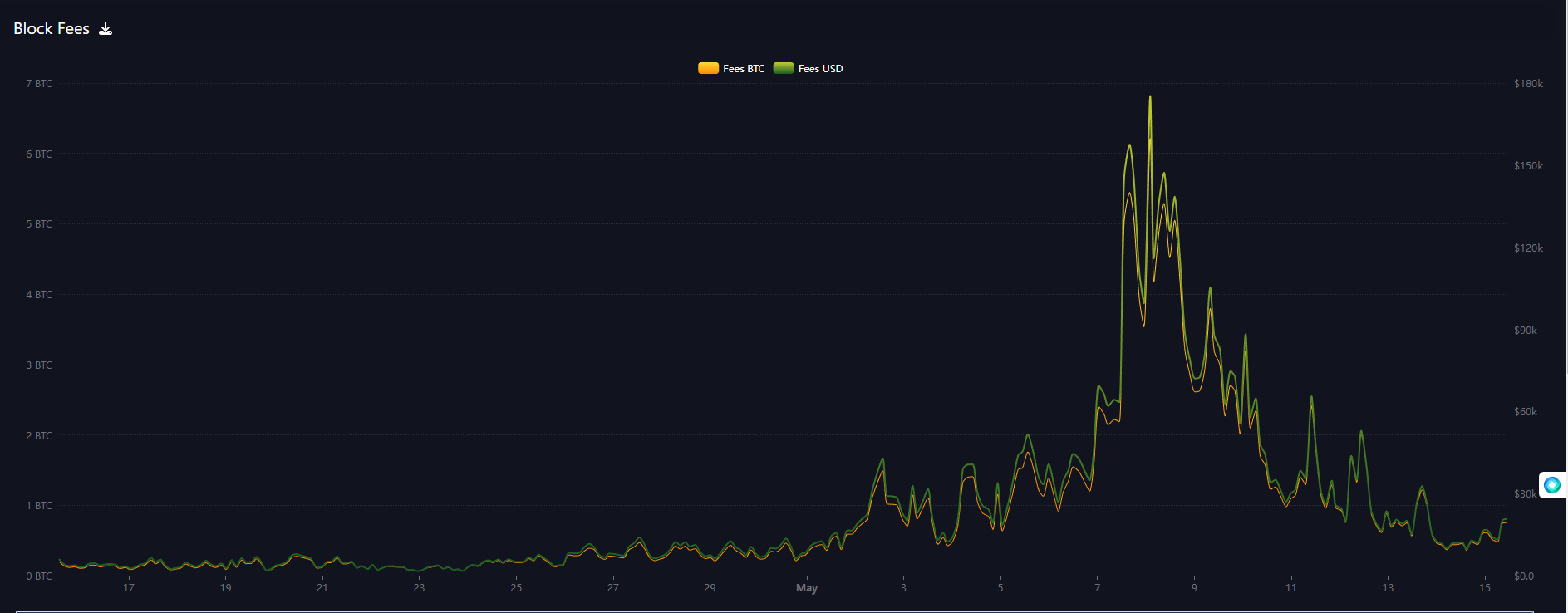

However, activity on the network has boomed this month, with block fees averaging as high as $176K per block (on average a block is generated every 10 minutes).

Transaction fees are going up because of huge interest in BRC-20 tokens, Ordinals, and the advent of Bitcoin-based smart contracts.

The new BRC-20 standard allows bitcoin to “do more stuff,” like issue NFTs (pictures and videos embedded in the blockchain) and offer decentralized exchanges, like other blockchains.

The bitcoin purists are not happy about these new developments, as they are “clogging up” the blockchain but the bitcoin miners are quietly pleased, as their revenue is climbing significantly with no extra cost or work on their behalf.

By the way, I own a lot of stock in public bitcoin mining companies. I am happy.

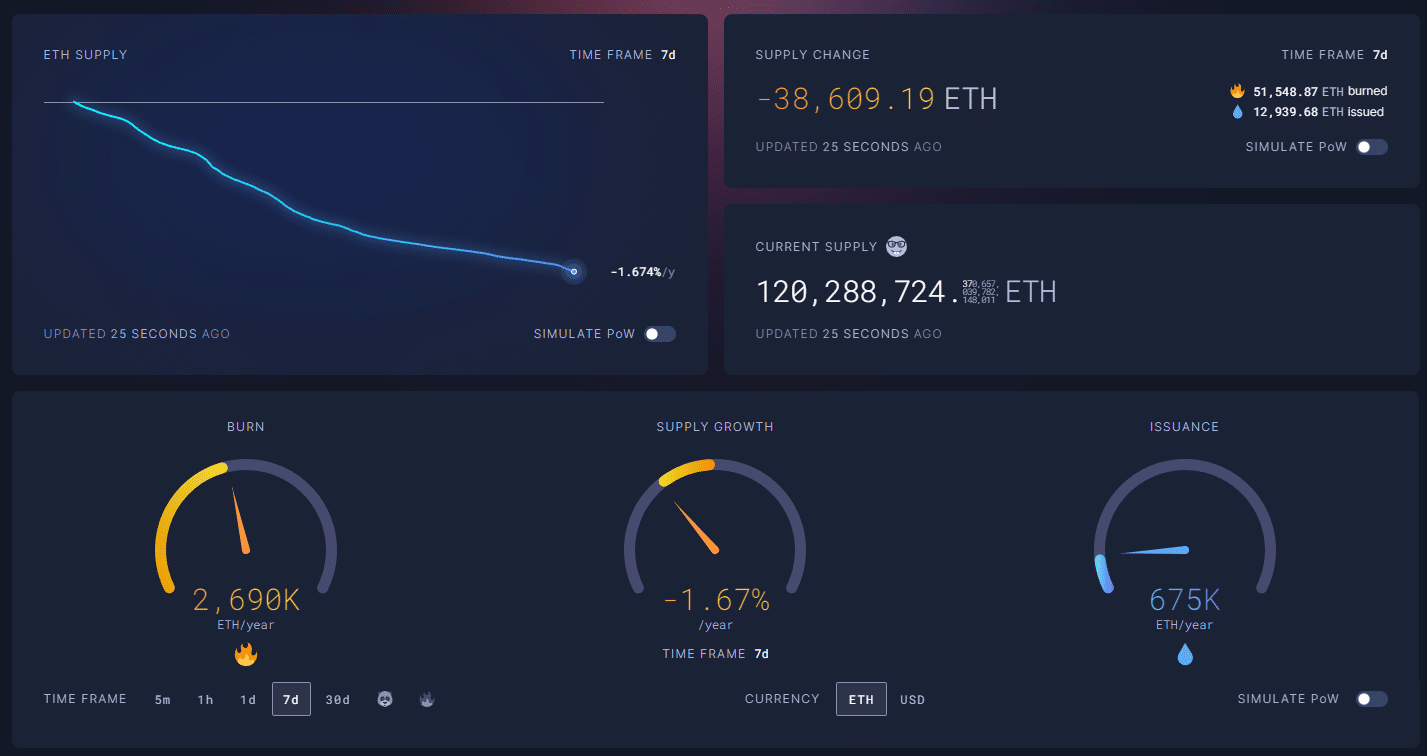

The fundamentals of Ethereum also continue to improve. Because of network upgrades over the last year, the amount of Ethereum in existence continues to decline.

The amount of gas that is used every day consumes more than the amount of Ethereum that is rewarded to “stakers” who process transactions and safeguard the integrity of the network.

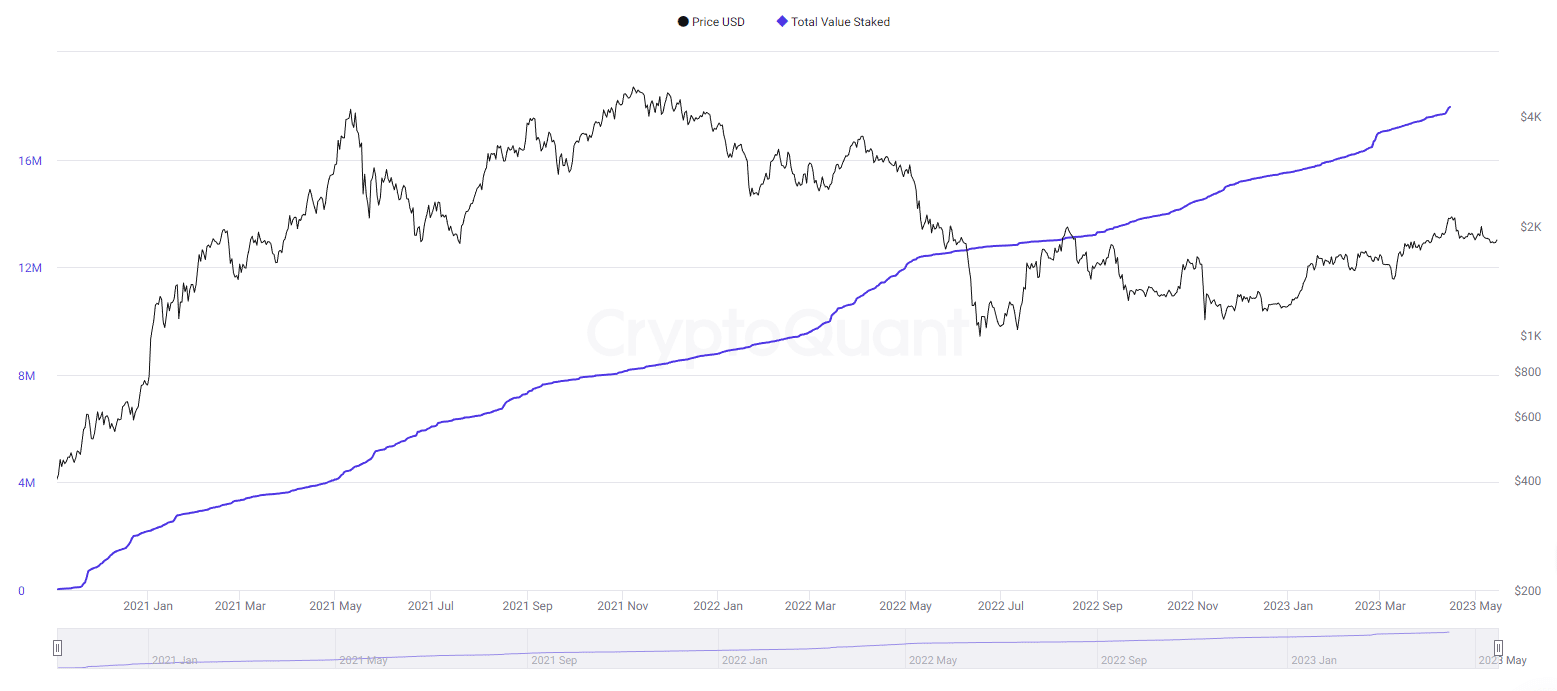

Another metric to keep an eye on is the amount of Ethereum “staked” i.e. taken out of circulation. It’s also rising

Well, in case you have been hiding under a rock for all of 2023, the US financial establishment, which includes the Biden administration and the SEC, among others, has decided that crypto is a threat to the US banking system.

Never mind that the Fed is jacking up rates and thereby forcing deposit outflow from US regional banks who dumped all their capital into long-term, low-interest US treasury bonds.

Nope, US regional banks are in trouble because of crypto and only because of crypto.

Anyhow, that means the heat is on US private financial institutions to back off from crypto. And sure enough, the latest news is that Jane Street and Jump Crypto are cutting back on their market-making crypto business.

However, despite the drumbeat of bad news in North America, a casual observer might note that crypto seems to be doing just fine.

One story that hasn’t got a lot of attention in North America is the imminent re-emergence of Hong Kong as a crypto-trading hub.

On June 1st, new regulations will come into effect in Hong Kong allowing institutions to offer trading services for crypto.

Before mainland China cracked down hard on crypto from 2019-2021, Hong Kong was THE center for trading crypto, and the North American exchanges were definitely second-tier.

Could it happen again? I’m not betting against it.

DJ