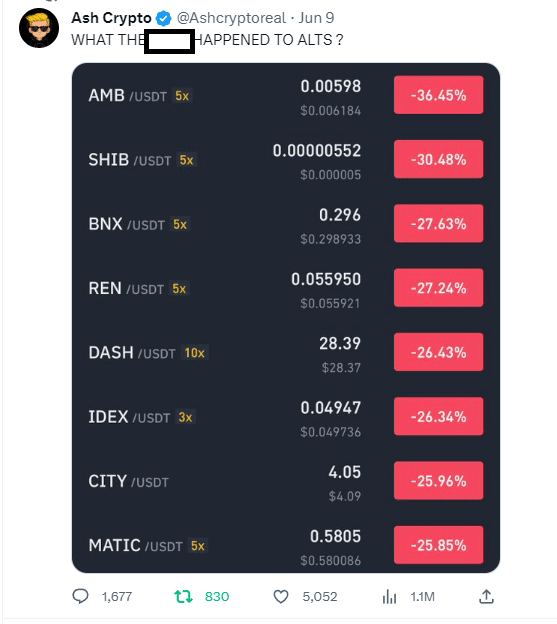

Altcoin Armageddon demolished many a crypto portfolio last week:

The immediate cause of this latest disaster is mean ole’ Gary Gensler, the head of the US Securities Exchange Commission.

In the space of one week, he managed to file suits against both Binance and Coinbase, the two largest crypto exchanges in the US.

He is also now on record as saying virtually all crypto-tokens and coins are to be considered securities, except for Bitcoin and possibly Ethereum.

Mr. Gensler’s actions had an immediate effect, with both Binance and Robinhood.com delisting many altcoin trading pairs, with predictable results.

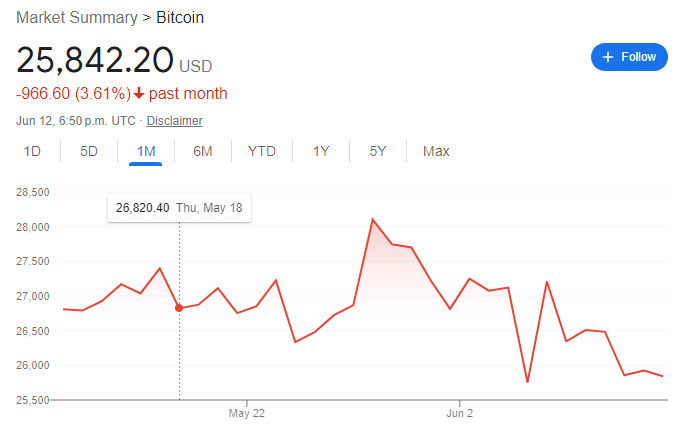

But what happened to the price of Bitcoin and Ethereum? Not much:

Considering it’s still up 50% since the beginning of 2023, I can’t complain.

And even though Ethereum is in Mr. Gensler crosshairs (we think), the market isn’t hitting the panic button yet:

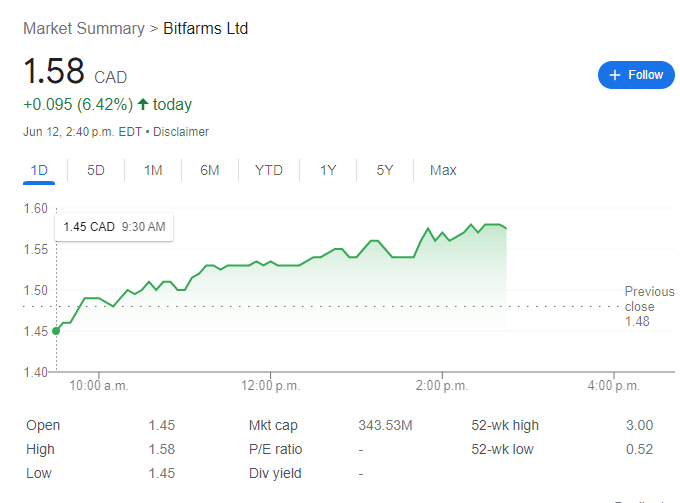

lastly, public Bitcoin miners are holding up remarkably well, with Bitfarms and its peers racking up 5% gains this Monday:

I guess you can say the actions of the SEC were a catalyst, but the crash was inevitable.

Coinmarketcap lists more than 25 THOUSAND different coins and tokens, across 642 different exchanges.

The total market cap of all crypto is slightly more than one trillion dollars. But the market cap of Bitcoin and Ethereum combined make up $709 billion, or more than 70% of the total.

By comparison, there are 4266 publicly traded companies in the US.

Consolidation in the crypto sector is inevitable.

In the early 2000s, we had ton of different search engines, each competing for user attention.

Examples include Yahoo, AltaVista, Lycos, and Excite, among others.

But today it’s Google that rules with 85% market share.

In the late 2000s we had social media platforms, revolutionizing how individuals connected and communicated online. Platforms such as MySpace, Friendster, Bebo, and Orkut were pioneers in the field,

But today none of those platforms are in business, and Facebook controls 65% of the social media market.

Technology sectors consolidate over time. It’s inevitable.

Platforms like Google and Facebook benefit from network effects, where the value of their services increases as more users join.

The network effect applies to crypto as well. Bitcoin may have old technology and very little of the “functionality” of the newer tokens with their smart contracts, but nobody is going to catch Bitcoin.

Economies of Scale: Ethereum has 5500 developers working on the blockchain and the ecosystem, almost three times as many as the next biggest competitor.

Thousands and thousands of tokens have development teams of less than a half-dozen. Many have only one developer.

User Trust and Habit: Over time, users develop trust and familiarity with established tokens. Nobody thinks Bitcoin is going to zero (except for a few cranks). Same with Ethereum. But the rest of crypto? Oh sure, most of the other coins will go to zero. This is not a controversial opinion.

It is somewhat remarkable that since crypto went mainstream in late 2017, here we are, two crashes later, we still have more than 25,000 tokens or coins in the market.

That’s probably due to two factors: the lack of regulation in the space and the extremely low cost of entry. For example, minting your own token on the Ethereum blockchain can be done for as little as $10K USD.

But it can’t last forever.

So how low do we go? Well, how many of these tokens are useful?

That’s a great question. My opinion is that at least 99% of tokens listed on Coinmarketcap are utterly useless and serve no purpose except to enrich the wallet of the issuer/promoter. And I’m being generous.

That leaves us 250 tokens, which still seems like a lot.

In five- or ten-years time, will we ever see a crypto-coin monopoly or oligopoly, where two or three coins/tokens dominate the market?

I would argue that with Bitcoin and Ethereum having 70% of the total market cap in crypto right now, we already have that.

It’s just the promoters and pumpers who are in denial and thinking if they put their hands over their ears and yell “la la la” loud enough and long enough, then bad ole Gary will go away.

DJ