Let’s pretend you are the portfolio manager of a bitcoin hedge fund and your job is to make 50% return a year. Or I should say, your commission is 20% of whatever you make for the client.

That means if you don’t make money for the client, you don’t get paid. So you are motivated.

You can lean back with hands behind head and park the bitcoin in a safe wallet and cross your fingers that bitcoin has another fantastic year like 2017.

Or you can do some work to earn your commission.

What I will show is a bit complicated but bear with me, if one day you are ever sitting on a lot of bitcoin, these strategies might come in handy.

The Futures Market for Bitcoin is Flat Which Makes Your Job Easier

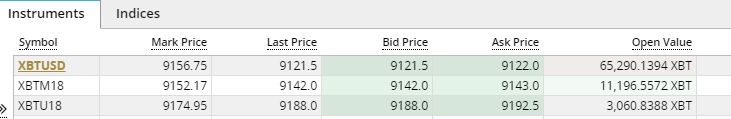

This is a screen snap from Bitmex, the largest bitcoin future exchange in the world, on April 25th:

Let me explain what those symbols mean.

The XBTUSD is a contract to buy bitcoin that never expires. It’s a perpetual contract meaning it pays interest OR the bearer pays interest depending on whether market is bear and bullish. A perpetual contract is different from a regular futures contract when there is a settlement date. In theory, you can buy into the XBTUSD and never have to sell, just collect interest (or pay interest).

The XBTM18 contract is the June contract, expires in two months (June 29th).

The XBU18 contract is the September contract, expires in five months (September 29th).

Remarkably, the price for all contracts is roughly the same between $9121 and $9192. There is no premium assigned to any of the futures contract.

That is to say, you can buy, up to 100x leverage, bitcoin futures contract that don’t expire until the end of September, for free.

Put it another way, if the end of September rolls around and the price of bitcoin is the same as it today, you haven’t lost any money. If the price of bitcoin goes up, you have made money.

What could possibly go wrong?

Aha, you think. If bitcoin goes down in price, you lose. And that’s true. Therefore, we need to do something to make our position a little less risky. We need to hedge.

Hedging is Complicated but Can Be Very Profitable and You Can Sleep at Night

Now we need to surf over to Deribit, another futures market that allows you to place calls and puts on bitcoin.

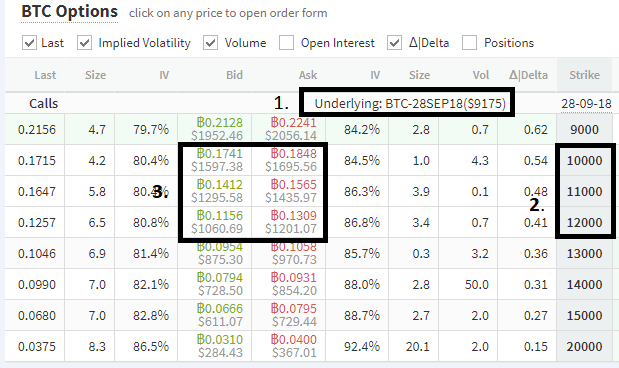

This next screen looks really complicated but let me explain. This is what Deribit is offering for call options:

- This the ending date of the contract (September 28th, 2018)

- The bid/ask value of the contract. Depending on the strike price of the contract, the market value is between the range of those numbers, i.e. between 0.1741 bitcoin or 0.1156 bitcoin.

- The strike price of the contract. Let’s focus on three different contracts: those with a strike price of $10000, $11000 and $12000.

Now what you can do on Deribit is short-sell the calls. This means for every one bitcoin you allow to be locked up as margin, you can sell one ‘call’ contract. Depending on the strike price, you will receive either 0.1741 or 0.1156 bitcoin which will be released to you on September 28th, 2018.

If the price of bitcoin stays below the strike price, you make money.

Easy and simple, no? Okay, let’s do a hypothetical trade and see how we can make some money.

An Example Where It’s Very Hard to Lose Money

It costs me one bitcoin to buy $18376 worth of bitcoin, at Bitmex, at 2:1 leverage. I buy the September 30th contract (XBU18).

Meanwhile, at Deribit I short the September 28th call contract at $11000, with a margin of one bitcoin, and I receive 0.1412 bitcoin. Note that the total, 1.1412 bitcoin is locked up until expiry (September 28th).

I have two bitcoins committed to contracts.

So what happens at the end of September when the contracts expires?

- If bitcoin is the exact same price as it is today, you get your one bitcoin back from Bitmex and 1.1412 bitcoins from Deribit. Return on investments in five months: 7.1 % in both bitcoin and dollar terms.

- If bitcoin goes up to $11,000, you have hit the jackpot. Leveraged at 2:1, you now have 1.197 bitcoin in your Bitmex account and you STILL have 1.1412 bitcoins in your Deribit account. Total bitcoin is 2.338 or 17% in bitcoin appreciation and dollar return on investment is 40%

- But suppose the price of bitcoin goes even higher up to $12412. That means the 0.1412 bitcoin premium you had on the Deribit contract has been eaten up. So you only have your one original bitcoin returned to you. But meanwhile, you have 1.35 bitcoin in your bitmex account. Return on bitcoin is 17.5%, dollar return would be 60%.

- But let’s take an extreme case (because that’s where you can lose money). Bitcoin blows the doors off and it goes to $16,500. With regard to your Deribit account, not only do you lose your initial 0.1412 bitcoin gain, you have to pony up an additional 0.5 bitcoin, so you are left with 0.5 in your account. ower However you are killing in Bitmex, with 1.8 bitcoins in the account. Total bitcoin is 2.30. Return on bitcoin is 15%, dollar return is 106%.

- Now let’s take the OTHER extreme case. Bitcoin drops 10% or down to $8269. You have 1.1412 bitcoins in your Deribit account. But you only have 0.80 bitcoin in your Bitmex account for a total of 1.9412 bitcoin. So you lost 2.8% in bitcoin, and in dollars terms you are down 13%. However, if Bitcoin drops only 5%, remember you are still up in bitcoin (.90 in your bitmex account, 1.1412 in your Deribit account or 2.04). And you break even in dollar terms.

Conclusion

That’s why investment bankers hedge. With this strategy, you make more money in dollars terms when bitcoin goes up. You make money in dollars if bitcoin stays the same price. You even break even if bitcoin drops 5%. And finally, if bitcoin drops 10%, you only lose 12.75% or an extra 3 % in dollar terms.

A good strategy to employ after a serious dip in the price of bitcoin. Like now.

Ross