It’s been a fantastic breakthrough in the last 12 months for Bitcoin and the other cryptocurrencies.

Both prices and coverage by mainstream media have soared. It seems everybody is getting into cryptocurrency.

So why can’t I buy coffee, or shoes, or even a dinner with Bitcoin? It’s not the case that merchant and business adoption it’s close to non-existent.

It’s true that there are still regulatory or technical concerns which deter small business who are usual first adopters.

However, the real problem can be summed up in one world: volatility.

A small company needs to pay rent, buy supplies, sell products and services, and pay its employees on an exact schedule.

Accepting Bitcoin, for these companies, is a bit like accepting lottery tickets as money.

Enormous volatility in the crypto markets make it impossible to predict whether a company’s balance sheet will be in the black or in the red on the exact day it has to pay its employees, or when rent or taxes are due.

At present there is no real incentive to adopt crypto that outweighs the dis-incentive of volatility risk.

Some argue that Bitcoin will eventually achieve stability, and that it’s violent market behavior is currently due to growing pains and relatively low trading volume compared to other major currencies.

Some people argue that the futures and derivatives markets will bring stability to crypto assets, because institutional investors will look to achieve predictable and specific price targets.

Unfortunately, that may not be the case.

Gold, one of the most mature markets in the world, sees regular fluctuations of more than 10% per year, losing more than 27% in 2013 alone.

Ironically, the volatility of Gold has increased over time, rather than decreased, which suggests there is no real positive correlation between market maturity and price stability.

It also doesn’t help that there is a contradictory mindset in the Bitcoin community which proclaims that Bitcoin will be the new world currency, but instructs its members to “HODL,” a meme derived from a misspelling of the word “hold” and sometimes mistakenly used as an acronym for “Hold On for Dear Life”.

The meme expresses both the belief that selling Bitcoin is almost a betrayal of its principles, and a distaste for those who sell their coins due to short term market fluctuations. .

Lending and Borrowing Markets

Without loans and lines of credit, businesses could not function, and very few people could afford houses and cars. Loans only work well because we have faith in the stability of money.

If, for instance, we lend someone one Bitcoin at a value of $20K and the price collapses down to $6K, as it has in early 2018, we lost an enormous amount of money.

If, on the other hand, we borrow one Bitcoin and its price triples, we may never be able to pay back the loan, especially if the price of Bitcoin keeps rising.

We would have to declare bankruptcy or be stooped in eternal debt, which makes the prospect of borrowing extremely risky.

For these and other reasons, it is unlikely we will ever see mass adoption of Bitcoin as a coin of commerce, because it is fundamentally a commodity and not a currency.

It is digital gold, which has an important place in the new economy, but will not replace the Dollar, Yen, or Euro.

To engage in the long-term activity of finance and commerce, we need more than just a valuable token we need stability.

Stable Coins

Stable coins are a new class of cryptocurrencies under development specifically designed to address the problem of volatility.

But before we begin, keep in mind this simple concept:

Money is a product, produced by a company and subject to market forces, just like any other product.

This is true for both cryptocurrency and conventional money like the USD, which is created and regulated by the government and Federal Reserve.

First Generation Stable Coins: Tokenizing Physical Goods

Most crypto traders who are active on Bitfinex and Binance have heard of, and used, the USD-Tether.

Tether is a crypto currency that lets exchanges and traders interact with one another in US dollars, without actually switching between crypto and fiat money all the time.

With all transactions kept on a blockchain, there are enormous savings on administrative costs and time to execute trade, not to mention the bypassing of regulations that are activated if you deal in real US dollars.

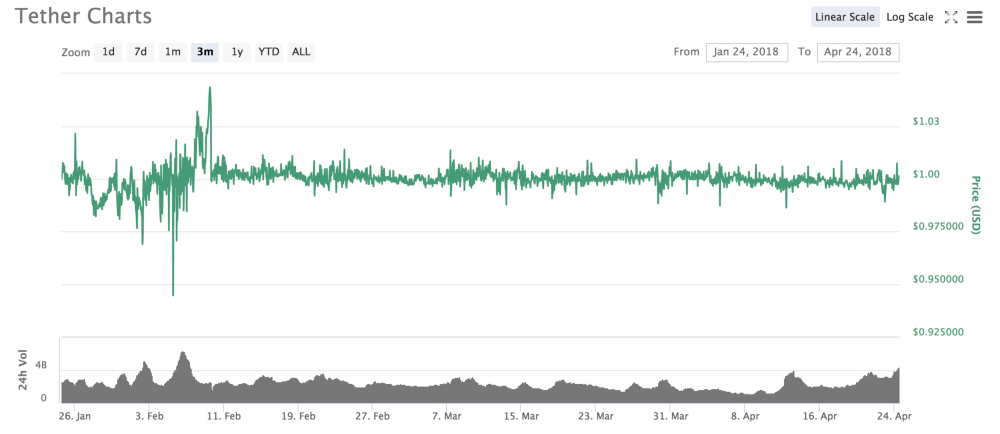

The mechanism behind Tether is straight forward: The Tether company creates one coin for every US Dollar it receives and locks away in its bank account. Thus, a one-to-one backing guarantees price stability against the dollar, because everyone already trusts the dollar.

The Tether coin uses the Omni protocol to ride on top of the Bitcoin blockchain, guaranteeing secure transactions and transparency.

Although Tether is great in theory, and has maintained excellent price stability, it also suffers from several weaknesses.

It is not decentralized, but controlled entirely by Tether Limited, which means it is vulnerable to attack and corruption.

Its backing funds are locked up in a few bank accounts in Singapore and Hong Kong, which means that the money can get seized or frozen by governments, adding a high degree of 3rd party risk.

Tether was not conceived of as a world currency, but as a tool for exchanges to increase efficiency and avoid taxable trading events for the exchanges and their users.

Since Tether is closely linked to the USD and wants to avoid legal restrictions or adverse government action, they have instituted a strict Know-You-Customer framework, which makes it very difficult for individuals to hold Tether themselves.

Rather, the exchanges hold the stable coins, while their users submit identity verification paperwork to trade them.

Questions have been raised about Tether’s business practices and transparency. There are allegations that it essentially engages in fractional reserve banking and thus does not hold one dollar for every Tether it creates.

Whether or not these concerns are warranted, they may undermine the entire currency whose value is predicated on trust. Thus, the actions and possible abuses of a single company could collapse the entire Tether economy.

Daunting as all these concerns are, Tether is consistently one of the most frequently traded cryptocurrencies by volume, not because it is particularly attractive to investors, but because stable coins are necessary for the crypto economy to function.

But there are other stable coins out there.

DigixDAO, has recently put physical gold into the crypto space, and several other companies are working on doing the same for real estate and other commodities.

Conclusion

There are many problems with the current crop of “stable coins” available to investors at present.

The current 800-pound gorilla, Tether, has been controversial and individual investors can’t really buy it except through approved exchanges, because of KYC (know-your-customer) legislation.

However, there are other solutions on the horizon to problem of volatility.

We will look at the next-generation alternatives in part II of our series.

Editor’s Note:

This story is based on original work by Aviv Milner & Victor Hogrefe of Blockspace, blockchain consultants. You can find more by Aviv & Victor at their website: www.block-space.info or email them at blockspace.aviv@gmail.com