Last week I talked about how it just got a lot harder to predict the future price of bitcoin and other crypto coins and tokens, as the market is now aware of the halving effect of bitcoin.

It’s harder, but not impossible.

In my news feed, future events that will affect the price of various crypto coins and tokens fall into three main categories. You could write a book on each of the factors; I will try to summarize in a few hundred words.

Technological Innovation

This is the big one, and I will give an example: At present, Ethereum is too slow and it’s too expensive to execute a smart contract (sometimes hundreds of dollars). That’s keeping the price down.

Last spring I predicted a price of $10,000 for Ethereum by end of 2021. I was wrong unless it more than doubles in 30 days (I doubt it).

Why did I predict that? Because last spring, it was forecast that Ethereum 2.0 would be released in January 2022, and would solve a LOT of the current throughput problems.

But the schedule has slipped. We are now looking at a March release, possibly late into June.

How do I know this? Because I subscribe to some geeky, non-investment, Ethereum newsletters that talk about the current state of development.

I am not a developer. I can’t write code to save my life. But I have hung around developers long enough to decipher the chatter about schedules. And the schedule slipped.

Now it’s going to be $10k Ethereum by the summer, at the latest. I can wait for that. I’ve been waiting for years.

And that is just Ethereum. There is a TON of technical innovation that happens in crypto every day. It’s like drinking from a firehose.

Right now the hottest thing in crypto is ohm forks. And no I’m not going to even attempt to tell you what that is. I’m not writing a book today.

Regulatory Blowback

A classic example is China banning crypto. It’s happened so often that it’s a running joke among crypto veterans. But it works!

China bans crypto and the price of bitcoin tanks.

Another example is the American Securities and Exchange Commission turning down an application for a Bitcoin ETF (not to be confused with the toxic Bitcoin Futures ETF). They have turned down dozens over the years.

But the price of bitcoin always dips on the day of that announcement. Go figure.

Those are stories that I watch out for.

But there are also stories that I completely ignore. The classic oh-please-I-don’t-care story in crypto is when some government official/investment guru/financial regulator sits down for an interview and dumps all over bitcoin and crypto.

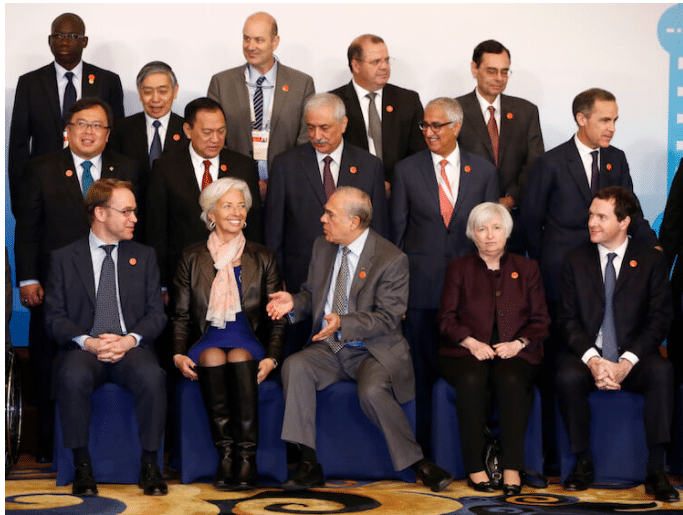

A shortlist of the usual suspects would include Hillary Clinton, Elizabeth Warren, Jamie Dillion, Warren Buffett, Christine Lagarde, and various governors of central banks.

I swear that somewhere there’s a story template for interviews with these people and it never varies.

Question: Which government official in the picture doesn’t hate bitcoin? Answer: Trick question, they all hate bitcoin.

If you are not sick of reading those articles by now you must be new around here.

Derivative Markets

Do futures and options traders try to manipulate the price of bitcoin and other crypto products?

You bet they do.

After writing for almost four years about crypto, I have written a ton of articles on how the derivative markets play around with the price of bitcoin for fun and profit.

To summarize:

On the fourth Friday of every month, the monthly crypto contracts expire or settle.

But for big traders, it’s hard to settle or roll over your contracts in one day or two. Sometimes it can take up to a week.

Therefore, a big spike in the price of bitcoin tends to happen in the first two weeks of the month. Then the price can even spike down in the last ten days of the month.

For the months of September, December, and April when the quarterly contracts settle as well as the monthly, the volatility can be even more pronounced.

I will make a prediction just for fun: Because the fourth Friday of the month falls on the 31st of December this year, I predict the price of bitcoin will go up until the 18th of December.

But on Monday, the 22nd of December, the price of bitcoin will stall and may even start to tank.

Let’s see how it plays out.

DJ