If you carefully cherry-pick the data, you can come up with some real winners for the first half of the year.

Bitcoin is up more than 80% since the start of 2023.

NASDAQ is up 30%. Even the S&P 500 is up more than 14%.

But those numbers are misleading. This isn’t a broad-based rally (yet).

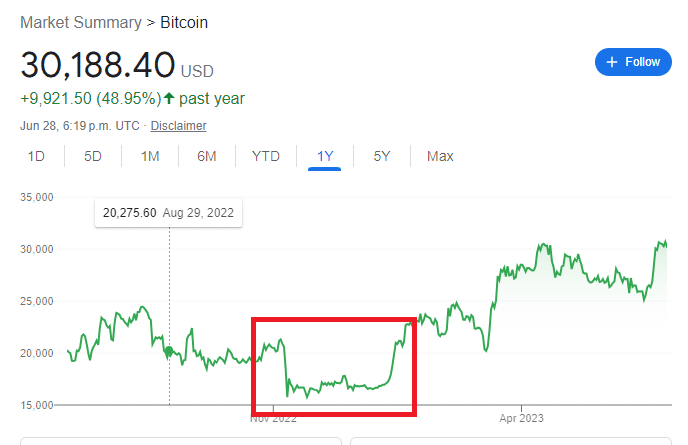

Let’s start with Bitcoin. The year-to-date number looks great because of the huge trough that Bitcoin found itself in in the last quarter of 2022:

Now, a fifty percent gain in one year still sounds very good, until you realize that we are still more than 50% off Bitcoin’s all-time high of more than $65,000 USD.

If you invested in an ETF just tracking the performance of the NASDAQ at the beginning of 2023, then congrats, you have done very well.

Even the one-year return, i.e. since June of 2022, is an impressive 21%.

However, if you tried to pick winners on the Nasdaq and missed out on the ArtificiaI Intelligence frenzy, it cost you big time.

If you didn’t own Alphabet (GOOGL), Meta (META), Apple (AAPL), Amazon (AMZN), and Nvidia (NVDA), then your return was considerably less.

As a matter of fact, some analysts have calculated that without those stocks, the NASDAQ would be flat this year.

Finally, both the NASDAQ and the S&P are still off their all-time high. In the last two-and-a-half years, the senior markets have been flat.

And That Was the Good News

Investors in the junior markets haven’t made a dime for a long time either, and there has been no relief in 2023:

For the Russell 2000, the US index for small cap stocks, you made less than 7% in the last year, and 6% year-to-date.

In the last five years, the index has grown a miserly 13%, an average of 2.6% a year. That doesn’t even match the inflation rate. Brutal.

Goldbugs have nothing to write home about either:

A five percent return beats inflation, but just barely.

My Personal Portfolio

How did I do? Quite well, relatively speaking. But I got lucky.

First, year-to-date, my crypto portfolio is up 53%, which sounds very good, but as you know, Bitcoin is up more than 80% in the same time period.

Virtually all of my crypto is now in Ethereum which is up 54%.

I was doing quite nicely yield farming for a few months in early 2023 but then the second-quarter crash in the altcoin sector wiped out any gains that I had. Such is life.

My stock holdings did much better. My overall portfolio is up 75%, despite a disastrous foray into Signature Bank which is now sitting close to zero.

Furthermore, my microcap blockchain stocks were dead when I bought them on the cheap in November. And now they are even cheaper.

My Bitcoin mining stocks were my salvation. As I mentioned in this article, it doesn’t matter what Bitcoin mining stock you bought at the beginning of 2023, all of them are up big,

And they continue to climb even in a market that’s dead for most everybody else.

I have TWO Nasdaq Bitcoin mining stocks in my portfolio, and they are responsible for ALL my gains this year, in my stock portfolio.

What to do for the Rest of 2023?

Read what the Very Smart Pundits in the Media are forecasting and seriously consider doing… the exact opposite of what they recommend.

In January, my newsfeed was filled with doom-and-gloom predictions that the unprecedented rate hikes by Jerome Powell were going to lead the economy into disaster and a stock market crash.

That prediction turned out to be completely wrong.

Now I’m reading that inflation is expected to pick up over the summer, leading to more rate hikes, which will NOW lead to disaster.

I should sell, according to the experts. But maybe I will hang around a little bit longer.

DJ