This is the second article in a series. The first is here.

In the short run, buying and selling bitcoin is for gamblers. But hedging makes you an investor.

The SEC may be ruling this week whether to allow bitcoin ETFs to trade. Many commentators think this event could be the end of the bear market and the start of another bitcoin bull run.

But many retail investors are wary.

In the long run, when investing in bitcoin, investors have made fantastic amounts of money, but in the short run many an investor has given most (if not all) right back.

Volatility is the enemy. Lessen it, or reduce it altogether, and you can stay in the cryptocurrency market for years.

Investors that can stay in the market for years have made fantastic amounts of money. But how to do that?

Simple. You hedge.

You need to go long and go short at the same time.

Then, whichever way the market goes, you are making money.

But that’s not enough. The trades have to be asymmetrical. Meaning, if the market moves in one direction, one trade pays off more than the other.

It’s like I said in my last article on hedging: When you bet the same amount of money on black and red in the roulette wheel, you need to make one of those bets pays off at more than two to one.

If you don’t understand what I am saying, please go back and my introductory article on hedging once more…

Going Long is The Easy Part

Here is just a list of how go long on Bitcoin:

- Buy bitcoin on Coinbase, Krakken, Coinsquare, or any one of the thousands of exchanges that sell bitcoin.

- Buy bitcoin on margin at Bitfinex, Krakken or any one of a dozen exchanges that allow users to buy bitcoin on margin.

- Buy bitcoin futures on Bitmex, GDAX or CME Group.

- Buy bitcoin call options on Deribit (or sell put options).

- Buy stocks on the Toronto Stock Exchange (Venture) whose price is highly correlated with the price of bitcoin (bitcoin miners, blockchain).

All of these methods allow for outsized returns on your investments if the price of bitcoin goes up. They also an excellent way to lose money in a downward market.

Based on a survey I sent out a few months ago, most senior investors dipped their toe into cryptocurrency by choosing #5.

Younger investors simply bought bitcoin, and young investors with a HIGH threshold for risk chose #3.

Both groups lost money. The “long” bet was the losing bet for most, if not all of 2018.

The Safer Route is Harder to Do: Going Short

- Shorting bitcoin on Krakken or Bitfinex (there are other exchanges that allow you to short bitcoin, but they are few and far between).

- Shorting bitcoin on margin: Again, Krakken or Bitfinex are the main players in this game, but there are new entrants all the time.

- Sell bitcoin futures on Bitmex, GDAX (Coinbase Pro) or CME Group.

- Sell call options on Deribit (or buy put options).

- Sell stocks short on the Toronto Stock Exchange (Venture) that are highly correlated to the price of bitcoin.

The first thing you notice about going short is there is a lot to learn.

Buying bitcoin is easy. There are now dozens of exchanges where is funding your account is five minutes of filling forms online, entering your credit card number and away you go.

It’s a different ballgame entirely with heavyweight exchanges like Bitfinex and Krakken. It can take weeks to get approve to trade on margin. Bitfinex won’t even touch you if you are a US citizen.

Once you get an account approved, an investor needs to learn the ins and outs of borrowing on margin within those exchanges. Sometimes, in periods of high volatility, the interest rate to borrow bitcoin can reach 1% a day!

But opening an account Bitmex is far easier, as all you have to do is deposit bitcoin. Within hours you can buy futures at anywhere from 2x to 100x leverage.

Not coincidentally, Bitmex is the favorite exchange for people who like to buy bitcoin futures. It’s very easy to put your money down. It’s considerably harder to understand the intricacies of each futures contract.

Bitcoin options contracts on Deribit are even hard to understand, especially when figuring out how much margin you need. Deribit is the only exchange where you can buy call and put options on bitcoin. I wrote an article on Deribit here.

The margin is calculated dynamically by algorithms that constantly monitor the price of bitcoin. If the price moves against your position, then more margin is required. If you didn’t leave enough margin in your account, then your position is gradually liquidated. Not fun.

On the other hand, the bitcoin contracts that I have been selling short on Deribit have paid out 17% in the last two months, or 102% on annualized basis. It has been well worth my time to sit down and read the fine print.

Yes, to hedge in crypto means an investor has to sit down and do his or her homework. But it offers the chance of asymmetrical trading and there is no other way you can put yourself in a heads-I-win and tails-I-still-win scenarios.

Let’s take the simplest form of hedging: You buy $6000 of bitcoin at 5-1 leverage and sell short $6000 of bitcoin at 5-1 at the same time. The price of Bitcoin is currently $6000.

Immediately, common sense tells you that it’s a perfect hedge, but you are wrong.

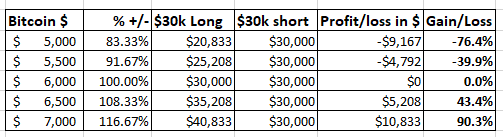

If you don’t believe me, let’s look at the spreadsheet:

The hedge is asymmetrical. That is to say, this hedge gives a bigger payout on the upside than it does on the downside.

Let’s put it another way. Let us assume that if bitcoin is priced at $6000, there is a 50% chance it will go to $5000 and a 50% chance it goes to $7000. It’s like a roulette wheel: 50% chance the ball lands on black, 50% chance it lands on red.

But unlike a roulette in Vegas (or Monte Carlo, or anywhere else in the world), the bets don’t pay out at 2 to 1.

Instead, in this “roulette wheel”, if bitcoin drops in price, you lose 76.4% of your money. But if bitcoin goes up, you make 190.3%.

Add those two numbers together, and you see that the roulette wheel favours the bettor, not the house. It’s asymmetrical.

Put it another way. Suppose bitcoin hovers around $6000 for the next five years. You cut your losses when it hits $5000. You cash out when it hits $7000. If this happens a dozen times or so, you make money.

How is this possible? It’s the nature of Bitmex contracts that are known as a quanto-derivatives. “Quanto” is short for “Quantity-Adjusting Option” which is a contract that allows to buy one currency (bitcoin) while the settlement (payout) is done in another currency (US dollars).

Sounds complicated? Let me try it again. If you short using a quanto-derivative, that means if the currency you bought (bitcoin) goes down, you don’t lose any money when settled in your “home” currency. Which in this case, happens to be US dollars.

Quanto-derivative have been used for decades by currency traders when they think their “home” currency (US dollar, British pound, Japanese Yen) will undergo a period of weakness.

Are you still with me? Because here is one more VERY interesting fact about quanto-derivatives. The upside is always greater than the downside.

Why? Because on the downside, you can only go to zero. But on the upside, you can go up more than 100%. That’s how you get the “roulette wheel” where red pays off at 2 to 1 but black pays off at more than 2 to 1.

That how, if you play the long run, you always make money.

And that’s a just one form of hedging in the world of cryptocurrency. There are more exotic hedges that offer bigger payouts and even less risk (like selling call options on Deribit).

The bitcoin trading pros all hedge. With a little bit of study, you can hedge too and make bank while sleeping at night.

Next article: the real world is messy and there are a few traps out there, even for hedgers. Stay tuned as I point them in my last story in this series.

Ross