Note: This is the third article in a series on why should hedge in crypto. Part one is here and part two is here.

What if somebody told you that they had a deal which guaranteed a compounded average return of 25% a year?

The only “catch” is that you have to lock up your money for four years.

Would you invest your money in this deal?

Let’s say you said “yes” and invested $100,000.

At the end of four years, you get back $78,000, for a loss of $22,000.

Were you cheated?

And the answer is, no, you weren’t. Because you didn’t consider the volatility of the deal.

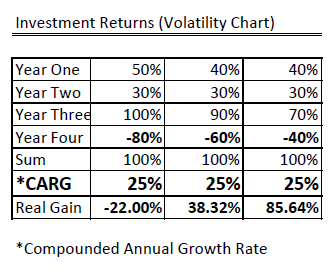

Let’s look at this chart:

As you can see, all of these “deals” average 25% return a year.

But the most volatile deal loses $22,000 while the least volatile deal gains $135,200 for the investor.

If this reminds of you of a Warren Buffet quote, you’re right:

“Rule No. 1: Never lose money.

Rule No. 2: Never forget Rule No. 1.”

I’m sure you have heard of that saying before, but I just showed you the math behind it.

That’s why the pros in the crypto-universe always hedge, seeking to reduce volatility.

I’ve said it before: long-term, it’s almost impossible to lose money crypto-investing. But in the short or medium term, volatility will bankrupt you. An investor needs to hedge.

I explained all the ways you can hedge in the world of crypto in the first article in this series, but here is a real-world example of cryptocurrency hedging.

This is Where I Have Put My Money, Long and Short

My three biggest cryptocurrency public company holdings are, in no particular order, DMG Blockchain (DMGI-TSXV), Fortress Blockchain (FORT-TSXV), and Cryptostar (will be trading next week, I participated in the financing).

I am LONG on these stocks for the following reasons.

- They are bitcoin miners and thus positively correlated to the price of bitcoin.

- They are trading near cash or net asset value.

- They have net positive cash flow or close to it.

Negative sentiment about crypto is through the roof when it comes to blockchain/bitcoin mining stocks that are listed on the Toronto Venture Exchange. Both DMGI and FORT are trading below their financing price, and I fully expect Cryptostar to trade the same way.

These stocks are great deals if you think the price of bitcoin is going to be above $10,000 USD by the end of the year. But very few TSX traders are betting on that.

These stocks are the LONG part of my hedge.

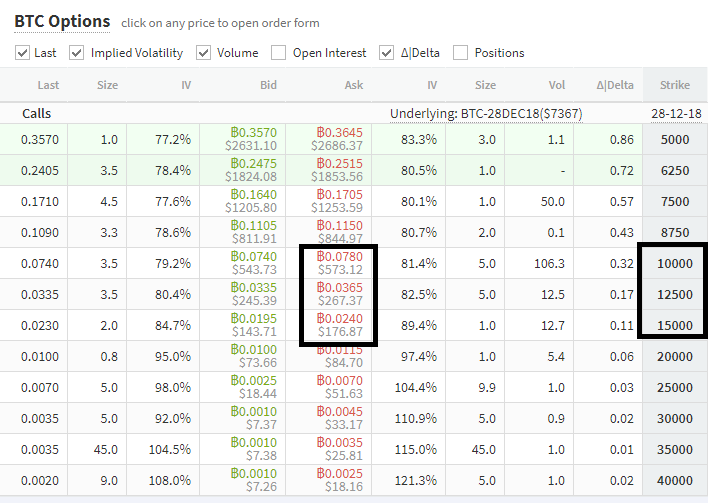

And then, there is Deribit. It’s the only exchange in the world where an investor can buy or sell option contracts on bitcoin. Here is a screenshot of call options that expire in December 2018.

Note the numbers in the highlighted boxes.

The contract to buy bitcoin at $10K costs you 0.074 bitcoin or 7.4%.

The contract to buy bitcoin at $12.5K costs you 0.0365 bitcoin or 3.65%.

The contract to buy bitcoin at $15K costs you 0.0240 bitcoin or 2.4%.

That means if you are selling these contracts, you are paid either 7.4%, or 3.65%, or 2.4% for locking up your money for 3.5 months.

Therefore, your annualized rate of return is either 25.4% or 12.5% or 8.22%.

However, we must remember that Deribit allows you 3 or 4 to 1 leverage without interest costs.

Therefore, the true rate of annualized return at 3 to I leverage is either 76.2%, or 37.5% or 24.7%.

This is the nature of a hedge. If the price of bitcoin goes down, or stays below $10K until December 18th, an investor keeps all the money.

If the price of bitcoin soars above $10K, then options will become a money-losing proposition but the appreciation in my stock portfolio should more than make up for whatever I lose on Deribit.

Personally, I am hoping I lose all my money on Deribit because I suspect that if bitcoin tops $10K, then these bitcoin mining stocks will soar.

Selling Deribit call options is the SHORT part of my hedge.

Conclusion

If you have made this far into my series on hedging, congratulations, it’s been a bit of a tough slog. But I think you will be richly rewarded for your efforts.

To summarize: Reducing volatility will increase your investment returns and that is an absolute fact (check my math if you don’t believe me). That is the first reason an investor should hedge.

Secondly, hedging is a great way to play off the bulls against the bears. The bears on the TSX think bitcoin mining stocks are worth little more than cash in the bank.

The bulls on Deribit think there is a significant chance bitcoin will be above $10K by end of year (in which case, those bitcoin miners will be amazing money machines).

Who is right? I don’t know, and I don’t care, I’m hedging, and I will profit either way.

Ross