Today I see green everywhere.

Bitcoin is up 4% to $30,700 USD. Ethereum is up 6% to $1927.

Even the no-hopers, aka public crypto-stocks are giving the markets some love. Hive Blockchain is up nearly 17% to $5.91 CAD. Voyageur is up 7% to $3.47 CAD.

Truly, we have exited the gates of hell and now we can frolic in the grassy fields of Valhalla. No, just kidding.

EVERYBODY is forecasting a summer rally, including myself. And everybody is keeping a wary eye on September.

Because again, that’s when everybody says the floor will collapse, and we truly tank… …everywhere.

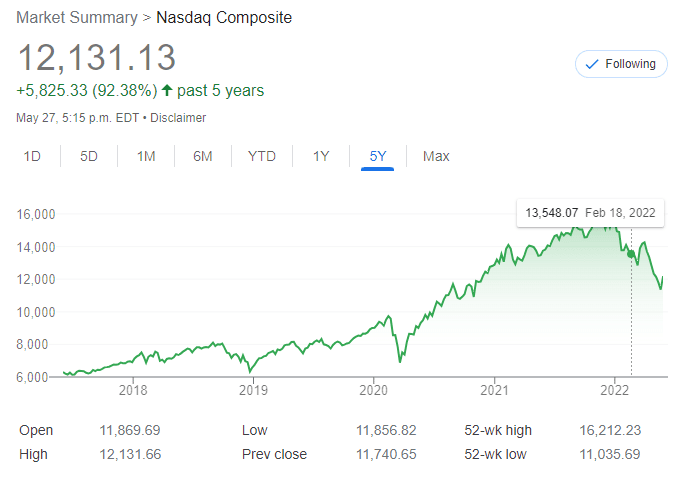

Meanwhile, when you have no idea where the market is going in the next month or so and the wife has forbidden you to cut open another chicken to examine the entrails (it makes a mess in the kitchen), you look at… charts:

Um, does this mean we are going back up to 14,000, or are we just taking a quick break before breaking down to 10,000?

Oh, I don’t know. Stock charts are like Tarot cards to me. You need to find a guy who has a good patter who will tell you what you want to hear and convince you to bet the kid’s college savings on the hot stock of the day.

Whales and Plankton

I don’t think it’s retail money going back into the market (yet), it’s institutional. And they are going back in for one of two reasons.

One, they are seeing data points not available to the average investor. Maybe inflation has come to a screeching dead halt. Could it be that Tesla has figured out how to make batteries costing just a six-pack of Coke and a bag of Doritos? Or perhaps Putin has had a change of heart after binge-watching “Hometown Cha-Cha-Cha” on Netflix and wants to make nice with Zerensky (“My bad, bro, I’m going to stop shelling Severodonetsk now”).

Whatever. Just remember we are playing poker here. As retail, we only get to see the cards in our hand, while the whales get to see cards in the deck. How many cards, I don’t know.

But what could be the second reason?

Bait

.

Institutional isn’t finished dumping but they are taking a pause. Maybe they are even buying on low volume to pump the asset of whatever they want to dump in the fourth quarter.

Some of them are perhaps close to margin calls, in which case they have nothing to lose by shooting the last bullets in their gun to push the price ever so higher so they can perhaps extract themselves by attracting some retail capital (*cough* Solana *cough*).

Always remember, as a retail investor, we are nothing more than a tasty snack to the institutional guys. We are nothing but exit liquidity.

What to do, then?

What’s My Investing Strategy?

I have been crypto-trading for five years now and have yet to hit up my neighbour’s recycling bin for returnable bottles and cans (ok, I came close to doing so in 2018 and 2020).

In that time I have developed a number of investing techniques. One of my strategies is to turn off the computer and crack open a bottle sent from one of our wine clubs in Osoyoos.

But I’m not doing that yet, it’s only Monday.

I am currently implementing another one: the dumb-dumb strategy, as in I feel dumb when the market goes up and dumb when the market goes down.

A short explanation: in a volatile market, you must reduce volatility. It’s not the 50% drawdowns that kill you in the world of crypto, it’s the 90% heartbreakers that drive you out of the sector and force you to get A Real Job (the horror).

The easiest way to reduce volatility is to get into cash. Cash, (or USDC), is your friend. I’m not 100% cash. I still have enough crypto in the market that I wince when it drops another 10%. And if it goes up 10%, I am rueful that I didn’t buy more.

To summarize, my strategy is to feel a little bit dumb every day. But to stay solvent.

Volatility is your enemy. Especially this year.

Do I think Bitcoin will one day zoom past $100K? Yes. Will Ethereum blow past $10000? Absolutely, one day.

But will bitcoin dump to $15k and Ethereum drop to $1200 before that?

Nobody knows for sure. Everybody is guessing and trying to tell a good story.

The human consciousness has a near-irresistible desire to make sense of chaotic events, to build a narrative out of randomness.

Don’t do that.

This rally will end, that is certain. Whether it ends tomorrow or carries through until late August, I don’t know.

I have adjusted my portfolio accordingly.

DJ