Note: This is the second part in a series on “stable” coins. Part I is here.

The entire world’s supply of money (M2) is roughly $60 trillion. Market cap of all cryptocurrencies in the world: $350 billion.

The total amount of US dollars in the world is $14 trillion (but would you believe for China it’s $25 trillion). The market cap of bitcoin is $150 billion.

In other words, the market cap of bitcoin is about 0.25% the market cap of the world’s money supply, and about one percent of the world’s money supply in just US dollars.

But bitcoin right now is an investment vehicle. It’s just too volatile to be used as currency.

Hence the search in the crypto-world for a “stable” coin.

As discussed in our last article, Tether is the most popular stable coin in use today, but it suffers from serious structural problems, i.e. many people believe it is NOT actually backed 1 to 1 by the US dollar as they claim.

But other solutions are on the way.

One solution is: digital collateral.

Let’s start with a well-known cryptocurrency, either bitcoin or Ethereum.

You lock up the bitcoin or Ethereum into a particular type of blockchain called a Decentralized Autonomous Organization(DAO).

The DAO exists as a price volatile token, granting voting rights and promising dividends to its owners, while the stable coin token created by that DAO is its product.

The resulting coin is a two-token model. One token is volatile offering the prospects of returns for investors (or speculators.).

The other token is stable, meaning it doesn’t fluctuate in value. Therefore, it can be used as currency.

The stable token is like a futures contract, except the contract has no expiry date. If you buy a “stable” coin that is pegged to the US dollar, you are essentially buying a contract that promises to pay you one US dollar in exchange for one coin, forever.

The contract or the “stable” coin is backed by another contract that is volatile, and thus is of interest to investors, or those trying to speculate on future price swings.

In practice, this means that any Ethereum or Bitcoin user can lock up, say, $150 of their funds in a smart contract, and thus create approximately $100 of stable coin tokens that can be used without restriction.

The user holds a special right to the locked-up Ether or bitcoin, which can be reclaimed if $100 is paid back into the contract.

Another solution is to use coins with algorithmic stability.

When Richard Nixon severed the connection between the US dollar and gold in 1971, It took some time for the general public to acknowledge that its money was no longer backed by anything but trust in the US government and Federal Reserve.

Considering inflation was a serious problem during the seventies, we can say that the public took a long time to trust the Fed.

Algorithmically stable coins seek to achieve stability purely by implementing automated monetary policy, replacing the role of the Federal Reserve with lines of code.

An issuing agency (like a DAO), must be able to automatically expand and contract the money supply, and create incentives, such that market forces will naturally stabilize the coin’s price.

Several models have been proposed to achieve this by issuing bonds, or credit tokens, which promise future returns to the owners, while others seek to freeze proportional amounts of coins that are placed in special smart contracts in the hope of being issued newly minted currency.

There is one coin out there that uses algorithmic stability. It’s called NuBits.

NuBits is two-token model consisting of network tokens and currency tokens.

If Nubits rise above the pegged value to the US dollar. there are mechanisms in place for the system to issue new tokens, thereby driving down the price towards the pegged value.

What happens if NuBit falls below the pegged price?

Users can elect to park their coins in special accounts, which essentially removes them from the money supply, creating upward price pressure.

These parked funds then generate interest, by being issued new coins when the network votes to mint new ones.

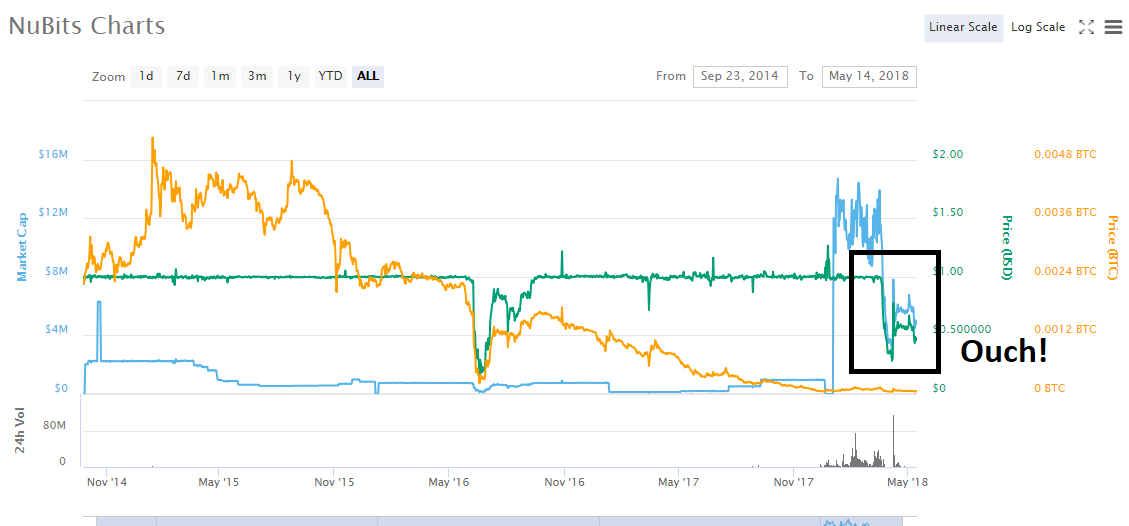

How has NuBits performed so far?

The green line is the value in US dollars. The blue line is the market cap in US dollars. The gold line is price in Bitcoin.

As you can see, with only one hiccup in the middle, NuBits was remarkably stable for more than three years, from November 2014 to January 2018.

Then, in the great crypto-nuclear winter of 2018, it collapsed.

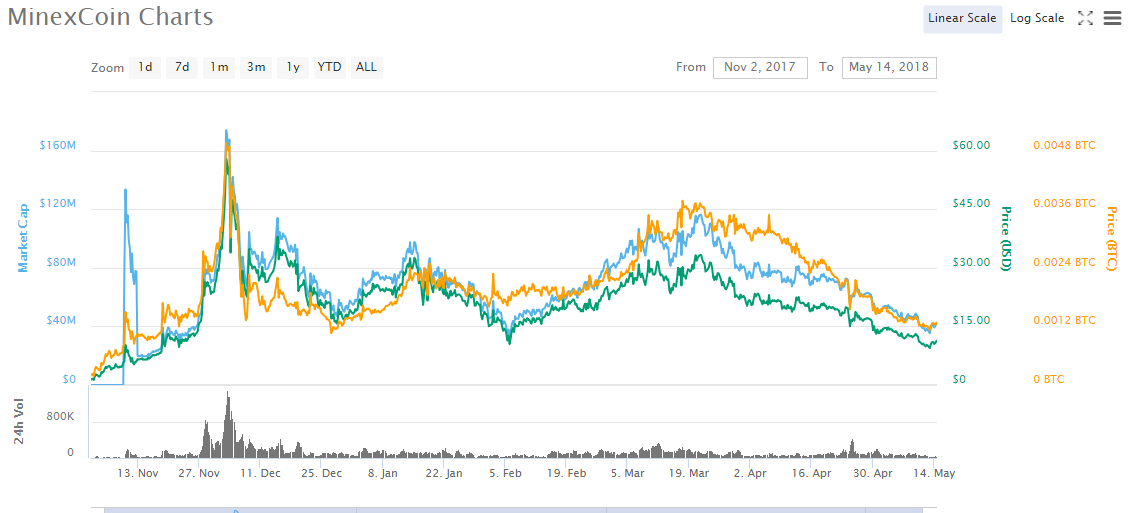

Another example of a stable coin is the Minexcoin, which I wrote about back in early September 2017.

Here is the chart for 2018:

As can see, it’s not much better. From a low of $6.50 in November 2017, it briefly reached a high of $49 in December, but now it’s sitting closer to $10 in May. 14, 18

At present, there is one big problem in trying to build algorithmically stable coins: rapid growth and skewed incentives.

When a coin first gains traction, the issuance of new coins is in the interest of those who are already holding.

Early adopters stand to gain more due to their relatively large credit, or network share positions. Thus, they are incentivized to advertise the coin and attract attention and excitement.

This can lead to a hype cycle, as many new buyers come into the market, driving up the price.

To stabilize the price, the algorithms will issue more and more coins to credit and network share holders.

But enough new coins are issued, and the flow of new adopters slows or even stops, holders will want to cash in on their profits, creating downward price pressure and risk of destabilization.

Since most potential profit is with early users, there is no real incentive to stick with an older coin, once a new one comes along and repeats the pattern.

The difference between the US dollar and an algorithmically stable coin is that the stable coin relies solely on trust and voluntary participation. The system can only work if every member stands to benefit from it.

Conclusion

As of yet, there is no stable coin that is easy to buy and well-trusted by most if not all members of the crypto-community.

But developers in the crypto-community are still trying.

There is a pragmatic attitude that asserts money is nothing more than a regular product that can be manufactured and fine-tuned to fulfil a desired function.

Many different projects are competing against one another in order to create a future in which money is global, frictionless, stable and decentralized.

If and when such stable coins gains widespread adoption, it will revolutionize the world economy in terms of efficiency and sheer possibility.

Editor’s Note:

This story is based on original work by Aviv Milner & Victor Hogrefe of Blockspace, blockchain consultants. You can find more by Aviv & Victor at their website: www.block-space.info or email them at blockspace.aviv@gmail.com