One of the drawbacks of owning bitcoin for a number of years is the occasionally painful crick in the neck.

From looking over your shoulder…watching out for the next dump.

But lately, watching your back has been a waste of time.

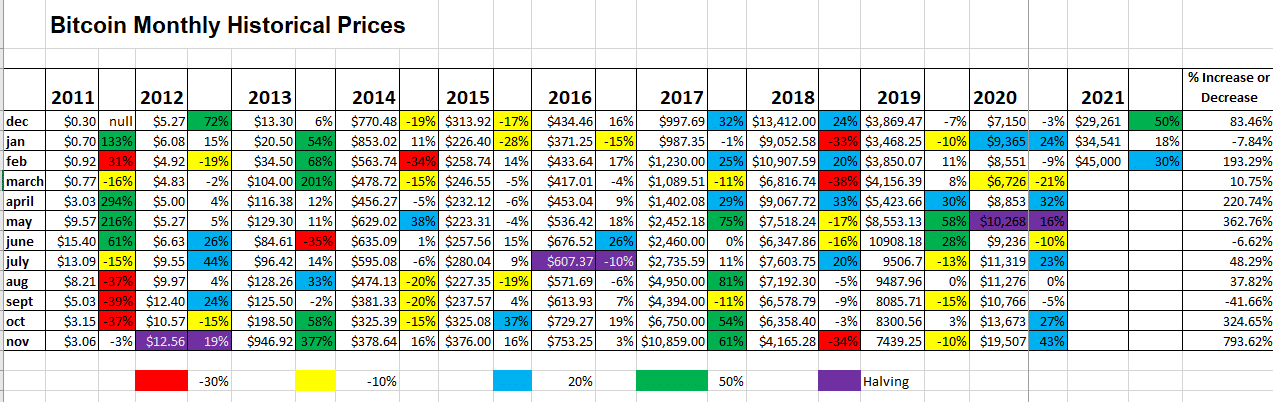

For the last five months (since October), Bitcoin has been on a tear, with monthly returns of 27,43,50,18, and 30 percent.

Yes, we have the longest winning streak in almost nine years, better than the great bull run of 2016-2017. So we should sell, right?

Not exactly.

First off, good luck in timing the dip. For example, if this super-cycle lasts seven months like 2012-2013, if you sell now, you miss out on another 25% gain.

Then, if you dawdle and don’t jump right back in, you would have missed monthly gains of 14% and 33%, not to mention the eye-popping gain of 377% in November 2013.

Then again, there are similarities to what happened in 2012-2013 and what is happening now.

At the beginning of 2015, Bitmex, the first futures market for bitcoin, debuted in Asia. That fundamentally changed the pricing dynamics for bitcoin.

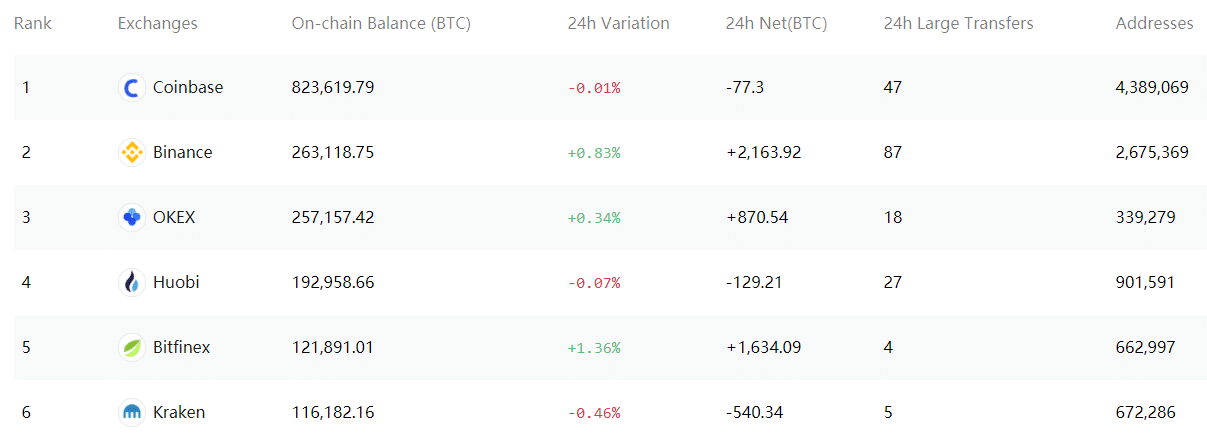

From then on, Asia controlled the price of bitcoin, through the derivatives market and through China’s dominance of bitcoin mining.

If you wanted to know the future price of bitcoin, you looked to the Asian futures market. If the contango (i.e. futures premium on bitcoin) was insanely high, then you knew, generally speaking, that the price of bitcoin was going to dump.

January is traditionally the time of the year when Asia shorts bitcoin (January, June, and September are the only months with a cumulative negative return in the price of bitcoin).

But because of Grayscale, it didn’t happen this year.

Conclusion

Eventually, the price of bitcoin will correct somewhat, or at least plateau. That’s the way markets work.

But in the next few months? If there is a black swan somewhere in the data, it’s hiding really well.