What Happens to the Price of Gold When it Goes Virtual?

Deprecated: preg_split(): Passing null to parameter #3 ($limit) of type int is deprecated in /home/newcurrencyfront/public_html/wp-content/themes/jannah/framework/functions/post-functions.php on line 805

Not many people paid attention to the announcement made last week that Tether is issuing a new gold-backed stablecoin.

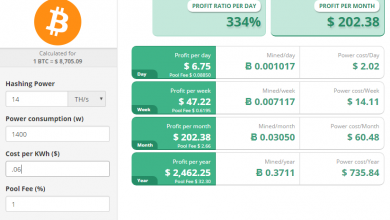

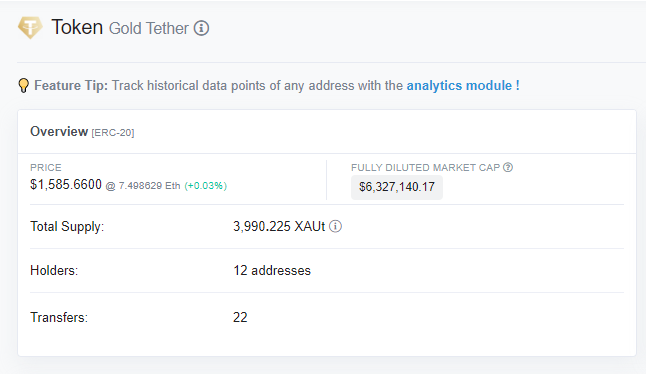

After two weeks of trading, it has a verified market cap of $6.3 million i.e. that’s how much Tether has been sold on the open market.

That doesn’t sound like much, but that’s six million in two weeks with not much publicity.

If we do some extrapolation, that’s about $160 million in sales per annum.

Of course, compared to annual worldwide sales of gold, $160 million is a drop in the bucket.

In China alone, in 2019, gold trading volume was $3.12 trillion USD. By the way that’s actual physical gold, not gold derivative which worldwide is estimated to have tens of trillions of dollars per year.

But that’s the point. Gold market capitalization is estimated to be about $3 trillion USD, meaning the price of gold is extremely hard, if not impossible, to manipulate.

That’s makes a very attractive foundation for a digital “stablecoin.”

Does the Tether Organization Have Enough “Brand” to Make the Coin a Sucess?

Not many investors in North American have heard of the Tether organization, except in a very negative way from the news media.

But if you trade crypto in Asia (which to be frank, is where most of the crypto-action happens, nowadays), the USD-backed Tether coin is an essential part of the ecosystem.

Many of the largest crypto-exchanges in Asia (and thus, the world), such as Bitfinex and Binance, try hard to minimize physical US dollar holdings because of regulatory and banking issues, but customers demand a safe harbour when they want to trade out of bitcoin or any other type of altcoin.

Hence the need for a trusted stablecoin.

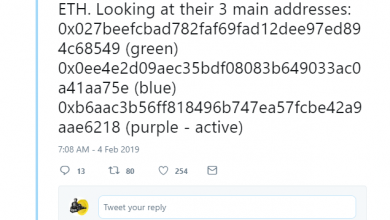

The USDT Tether coin has a current market cap of $4.6 billion USD.

If the AUT Tether coin becomes as popular the USDT Tether coin, then things could get interesting.

One ton of gold is worth $48 million with gold priced at $1500 an ounce.

If the Tether organization is truly backing their coin with 100% physical gold, that would be about 96 tons of gold.

In 2018, central banks were net buyers of gold with 536 tonnes of purchases.

However, note that about 2500-3000 tonnes of gold are produced each year.

Conclusion

It’s too soon to tell. But drop the North-American-centric googles for a minute or two and you can see the potential.

In many parts of the world, it’s a real pain in the rear-end to buy gold or gold-backed securities.

For example, in India, to buy gold, you have to pay a 12.5 import tax and a 3 percent sales, over and above what the jewellers will charge you.

And Indians love gold: annual consumption of gold is pegged as high as 900 tonnes a year.

I wouldn’t bet against Tether or gold this year.

Right now Tether gold is a bit of a sleeper but check back in three or four months. I think people will be surprised.