As Peter Krauth of Silver Stock Investor notes in his weekly email:

“the tightness in physical silver markets has only worsened. Incredibly, one-ounce American Silver Eagle coins are now selling at 100% premiums over the spot price! That means buyers are paying double the cost of the spot price for silver!

In the case of the Silver Eagles, supply tightness has been exacerbated by the U.S. Mint’s “management” of this product. So far this year, the Mint has only supplied 11.6 million ounces of this coin, half of the amount supplied through the first seven months compared with previous years with strong demand. In fact, supply is so tight with demand so strong, that bullion dealers are offering huge buyback premiums. APMEX is offering $10 over spot, while SD Bullion is offering $11 over spot.”

Does that mean I’m piling into silver? No, not yet. First, I have more reading to do.

It’s obvious that silver production not keeping up with the demand for silver, but before I take a plunge, I want to be sure there isn’t a stockpile somewhere ready for dumping.

For example, I heard a great story at a mining conference last summer. One of the speakers told a story about the last boom in silver.

The boom caused a lot of new shiny silver ETF to be minted. And what did a lot of retail investors do then?

They cashed in their 100 oz bars of silver for the ETFs, which of course caused the price to drop.

And what to buy? An ETF, or a pure silver mine, or a royalty play? So many delicious options to choose from.

In his or her heart, every crypto-investor loves precious metals, whether they admit it or not.

Will Ethereum Go Deflationary?

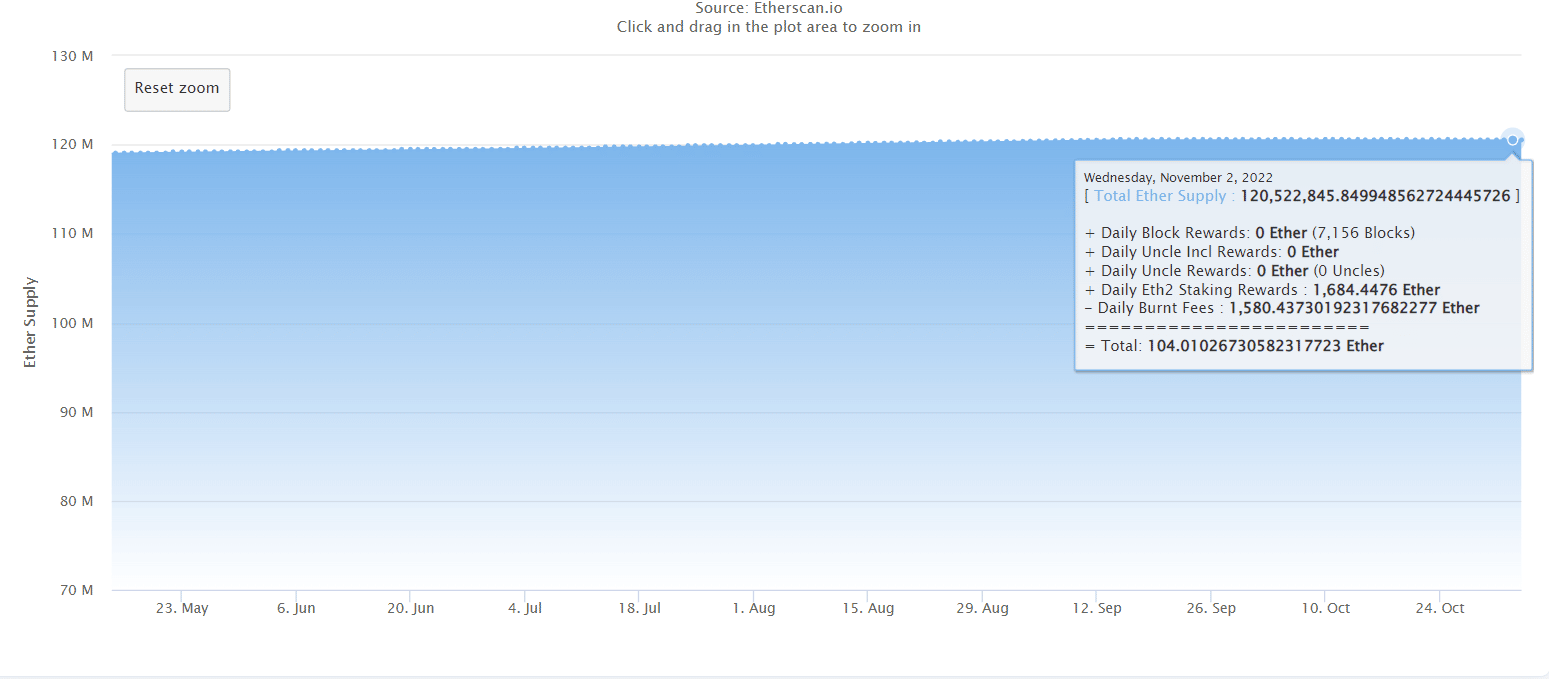

It’s getting there. I present to you the most boring chart of the day, possibly the month:

Also, transactions in the Ethereum blockchain have to be paid with gwei, or “gas” which of course is just the Ethereum token itself.

The burning of Ethereum is almost equal to the minting of new Ethereum.

Despite this being the season of crypto-winter, there is a still a lot of activity on the Ethereum blockchain.

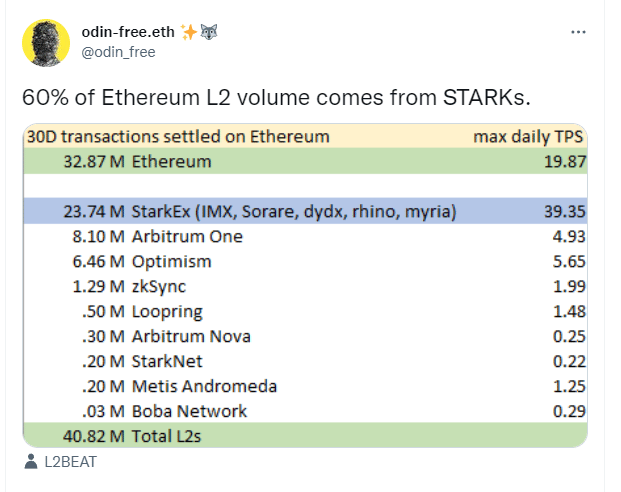

A lot of the transactions are generated by the “level 2” blockchains like Arbitrum and Optimism that bundle cheap transactions to be verified by the Ethereum main chain:

Not anytime soon. We probably have a least one more quarter of Powell being a fun sponge.

But I don’t see any other asset classes that are going to give greater gains in 2023 than Ethereum and maybe silver.

DJ