I know exactly how much the little guy made off Bitmex (the largest Bitcoin futures exchange in the world) every day.

For example, last Saturday they made $525,000.

How do I know this?

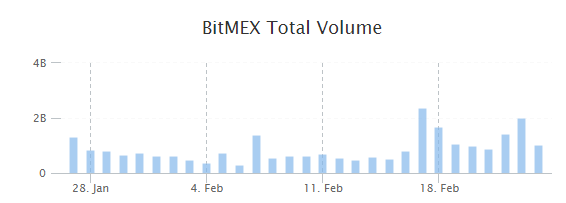

Trading volume on the Bitmex exchange was $2.1 billion USD last Saturday, February 23rd.

On every trade (with a few exceptions not worth mentioning here), Bitmex charge a trading fee of 0.075%.

On $2.1 billion, fees generated for that day were $1.575 million.

But Bitmex doesn’t keep all the fees to itself. Instead, it rebates one-third of the trading fees to the “market makers.”

Let me explain: On Bitmex, if you place a market order, or trade that will execute immediately at market price, you are the market taker. You pay a trading fee of 0.075% on the total value of the trade.

However, if you place a limit order, or an order that does not fill immediately, you are a market maker, and you get paid 0.025%.

That doesn’t sound like much, but $525,000 adds up to $192 million USD a year.

Remember, the 0.025% fee is charged against the total value of the order, not how much bitcoin you put up.

For example, if you buy a futures contract worth $100,000 but leverage at 100x, that means you are only putting up $1000!

But your rebate is $25 or 2.5%.

High frequency trading can pay off big, if you know how to do it.

By the way, Bitmex is not the only platform that offers rebates to market makers. Cryptofacilities, based out of London, UK, also offers a 0.03% rebate.

But Bitmex is by far the biggest exchange offering negative fees.

How They Do it: Robot Slaves Grinding out The Pennies That Add Up

This a screen snap of the trading action of the Bitmex exchange yesterday morning:

But most of the trading action is not done by human. Instead, automated trading robots (or bots) are grinding out a few dollars or pennies for their human masters with every trade.

Who build and operates these types of trading bots? Really smart traders like this: Kevin Zhou, co-founder of Galois Capital.

These traders don’t advertise that they are using trading bots in crypto, and they certainly are not for hire.

But every once in awhile, they do let the curtain slip and write up some of their trading strategies.

A short excerpt:

“The market is a giant poker table with millions of players sitting down, each of whom believes he or she can outplay his or her neighbor. And there is already a bit of self-selection for the people who sit at this table. Winning means playing better than a little bit more than half the capital at the table which, in turn, means you need to be better than 90% of the players since capital accrues to winners in power law fashion.”

Can You Be Better Than 90% of the Players?

If you are like me, you aren’t enough of a programming quant (quant=financial super-nerd) to build an automated trading robot.

But you can still make money trading in crypto.

I know this because I have being doing that for the last eight months. Next week I’m going to finally release my crypto-hedging strategy to the public. Watch out for it in your inbox.

DJ